No secondary reaction on the horizon

General Remarks:

In this post, I provided a thorough explanation concerning the rationale behind my use of two alternative definitions to appraise secondary reactions.

TLT is the iShares 20 years + Treasury bond ETF. More about it here

IEF is the iShares 7-10 years Treasury bond ETF. More about it here.

Thus, TLT tracks longer-term US bonds, whereas IEF tracks middle-term US bonds. A bull market in bonds entails lower interest rates. A bear market in bonds represents higher interest rates.

A) Market situation if one appraises secondary reactions not bound by the three weeks and 1/3 retracement dogma.

As I explained here, the primary trend was signaled as bullish on 7/22/22.

In my 8/26/22 post, I explained the development of a secondary (bearish) reaction against the primary bull market.

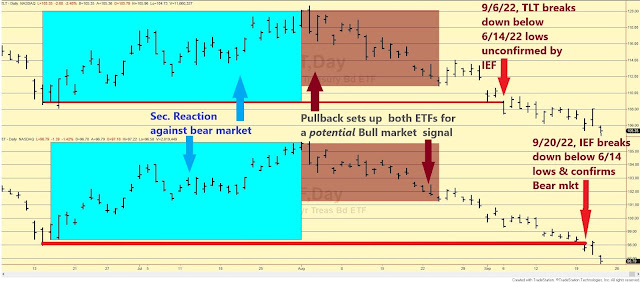

On 9/6/22, TLT broke down below its 6/14/22 primary bear market lows unconfirmed by IEF. On 9/20/22, IEF broke down below its 6/14/22 primary bear market lows confirming TLT, signaling a primary bear market. So, the primary and secondary trend is bearish now.

The charts below display the current situation. The brown rectangles highlight the pullback (secondary reaction) that developed against the then-existing bullish trend. The red horizontal lines show the primary bear market lows which have been jointly broken down. The small grey rectangles highlight a mini-rally that did not meet the requirements to set up both ETFs for a primary bear market signal (we need at least two confirmed days, and some "extent"). Please remember that under the Dow Theory, we have alternative ways to signal the trend change, which enables us to always have a “backup” plan in all market environments. Please read this post to know more. You need to know more. One thing is the “casual” application of the Dow Theory (which is doomed to fail). Another thing is to dig deeper into its understanding to master one of the best trend-following methods.

B) Market situation if one sticks to the traditional interpretation demanding more than three weeks and 1/3 confirmed retracement to declare a secondary reaction.

The primary trend was signaled as bearish on 9/28/21. A more aggressive and legitimate interpretation would have signaled the bear market on 9/24/21. The explanations here.

I explained in my 8/26/22 post the development of a secondary (bullish) reaction against the primary bear market and the setup for a potential primary bull market signal.

On 9/6/22, TLT broke down below its 6/14/22 bear market lows, unconfirmed by IEF. On 9/20/22, IEF broke downside its 6/14/22 bear market lows and confirmed. Such a confirmation entails three consequences:

a) The primary bear market has been reconfirmed.

b) The secondary (bullish) reaction against the primary bear market has been canceled

c) The setup for a potential primary bull market signal has been canceled too.

So now, both the longer and short-term oriented renderings of the Dow Theory are in gear. Both are bearish.

Below you have the updated charts displaying the most recent price action. The blue rectangles show the secondary (bullish and now aborted) secondary reaction against the primary bear market. The brown rectangles highlight the pullback that set up TLT and IEF for a potential (please mind the word) primary bull market signal, which was canceled by the confirmed lower lows. The red horizontal lines display the 6/14/22 primary bear market lows, which have been jointly broken down.

General remark:

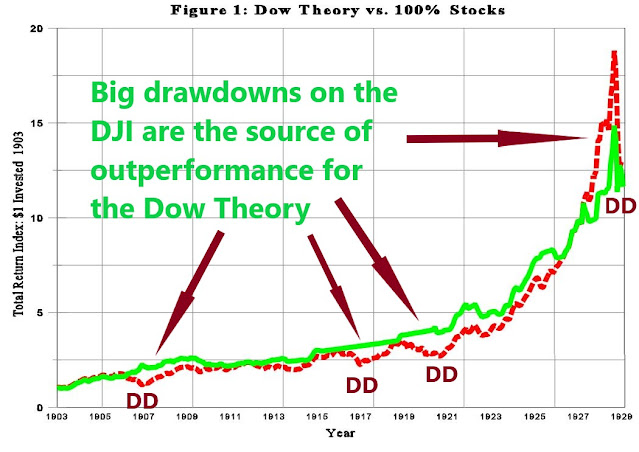

As with any long-term trading system that seldom triggers signals, performance should be evaluated by taking a sufficiently long observation period (I'd say at least 5-6 years for a portfolio and 10 years if dealing with one asset class alone). The link below offers you an evaluation of the outperformance and drawdown reduction operated by the Dow Theory when appraising the trend with TLT and IEF:

http://www.dowtheoryinvestment.com/2022/03/dow-theory-update-does-dow-theory-work_22.html

Sincerely,

Manuel Blay

Editor of thedowtheory.com