Executive summary:

• The gold and silver miners’ ETFs have been under a secondary reaction since 2/10/23 (more details HERE)

• The current secondary reaction notwithstanding, the primary trend for gold and silver remains bullish.

• I forecasted such a secondary reaction some days ago.

General Remarks:

In this post, I thoroughly explained the rationale behind my use of two alternative definitions to appraise secondary reactions.

GOLD AND SILVER

A) Market situation if one appraises secondary reactions not bound by the three weeks dogma.

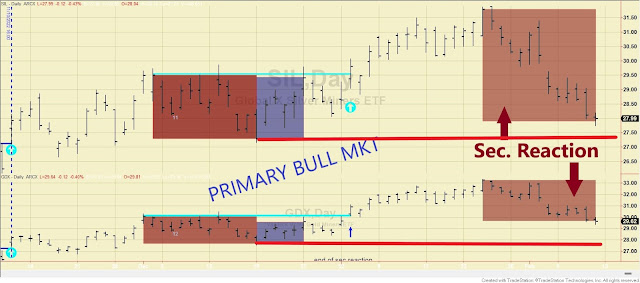

I explained HERE that gold and silver have been in a

primary bull market since 12/1/22.

A few days ago, I spotted three technical developments that made the ongoing rally suspect and made a secondary (bearish) reaction against the primary bull market likely.

Well, yesterday, 2/15/23, we got the expected

secondary reaction. From their respective 2/1/23 (GLD) and 1/13/23 (SLV) highs,

Gold (GLD) and Silver (SLV) declined for 10 and 22 trading days, respectively.

Hence, the time requirement for a secondary reaction has been met. As to

the extent requirement, it has also been fulfilled as GLD, and SLV’s

pullback amply exceeds the Volatility-Adjusted Minimum Movement (VAMM, more

about it HERE).

The table below gives you all the relevant data.

Therefore, the primary trend is bullish, and the

secondary one is bearish.

So, now we have the following options:

1. When or if we get a >=2 days rally exceeding the VAMM on at least one ETF, the setup for a potential primary bear market signal will be completed.

2. If

the rally continues until it takes out the 2/1/23 (GLD) and 1/13/23 (SLV)

closing highs, the secondary reaction will be terminated, and the primary bull

market will be reconfirmed.

3. If

no rally such as we described in “1” above occurs and GLD and SLV continue

lower and violate their 9/1/22 (SLV) and 9/26/22 (GLD) lows (red horizontal

lines in the charts below), a primary bear market will be signaled.

So, we must observe what happens in the coming days.

The charts below display the action that has unfolded since the primary bear market lows until now. The blue rectangles show the secondary (bullish) reaction against the then-existing primary bear market. The vertical dotted blue line highlights the day the primary bull market was signaled. The brown rectangles display the current secondary (bearish) reaction against the primary bull market. The red horizontal lines highlight the primary bear market lows, whose penetration would signal a new primary bear market (unlikely right now).

B) Market situation if one sticks to the traditional interpretation demanding at least three weeks of movement to declare a secondary reaction.

I explained HERE that gold and silver have been in a primary bull market since 12/1/22.

The current pullback does not meet the time requirement (at least 15 trading days), so there is no secondary reaction. Accordingly, the primary and secondary trend is bullish.

Sincerely,

Manuel Blay

Editor of thedowtheory.com