General Remarks:

In this post, I thoroughly explained the rationale behind using two alternative definitions to appraise secondary reactions.

GOLD AND SILVER MINERS ETFs (GDX & SIL)

A) Market situation if one appraises secondary reactions not bound by the three weeks dogma.

The primary trend for GDX and SIL turned bearish on 6/20/23. You may find an in-depth explanation HERE.

After some rallies that fizzled out before qualifying as a secondary reaction, at long last,

the rally that started off the 4/10/23 bear market lows finally reached the

time and extent requirement for a secondary (bullish) reaction against the

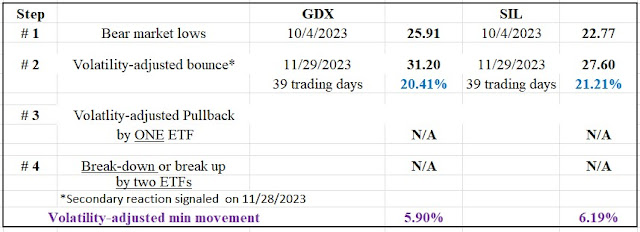

primary bear market. The table below contains the relevant dates and prices:

So, now we wait for a >=2 days pullback exceeding the Volatility-Adjusted Minimum Movement (more about the VAMM HERE) on at least one ETF to set up GDX and SIL for a potential primary bull market signal. We don't require confirmation When dealing with this kind of “setting up” pullback, as I explained in depth HERE.

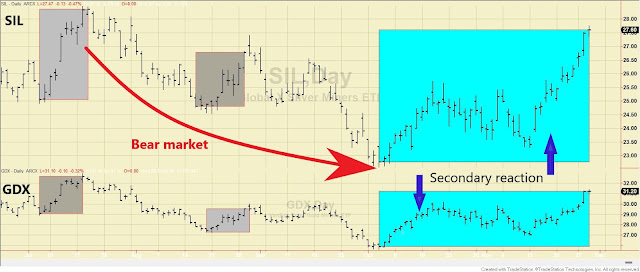

The charts below show the price action that started off the Bear market lows (Step #1), the bounce (secondary reaction against the bear market) that followed (Step #2). The blue horizontal line shows the secondary reaction highs (Step #2), whose confirmed breakup entails a new primary bull market. The blue rectangles highlight the secondary reaction (Step #2). The grey rectangles show rallies that did not qualify as a secondary reaction, and hence are ignored.

B) Market situation if one sticks to the traditional interpretation demanding at least three weeks of movement to declare a secondary reaction.

The primary trend was signaled

as bearish on 6/20/23, as I explained HERE.

In this

specific instance, the trend appraisal using the “long-term” version of the Dow

Theory yields the same results as the “short-term” one. So, what I explained above applies fully to this

section. The primary trend remains bearish and the secondary one is bullish.

Sincerely,

Manuel Blay

Editor of thedowtheory.com