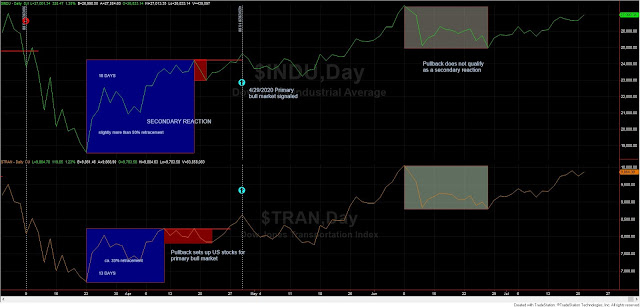

Is the time to (partially) unload nigh?

Rhea, in his actual trading, tried to avoid as much as

possible secondary reactions. He tried to unload near the end of a bull swing or at the very

beginning of a secondary reaction with the hope (many times fulfilled) of

replenishing his line at a lower price near to the bottom of the secondary

reaction.

To this end, Rhea devised several methods to

“guestimate” the end of a primary bull swing. To do this, he paid attention,

among many others, to volume, time, and, more importantly, divergence. Divergence

is not the same as lack of confirmation. Divergence means that one index is

going up whereas the other is going down. Countless times Rhea wrote that

divergence tends to be a harbinger of strong moves. Either in the direction of

the current trend, once the two indices get in sync again, or a counter move.

Rhea also paid attention to public sentiment, news, etc. Lots of euphoria

confirmed with technical action tended to increase the likelihood of a reversal

While not every trader has been cut out to trade like

Rhea, as trading like Rhea is time-consuming and requires nerves of steel

(hence my preference within the realm of stocks for Schannep’s Dow Theory which

is the closest thing to stress-free trading), I have eyes to look at the charts

and read the news.

I see too much bullishness in the air surrounding

precious metals.

I also see on the charts that volume has exploded.

Prices have indeed responded well by advancing nicely.

I also see today (July 23rd) that SLV closed lower,

whereas GLD made a higher high. So this is divergence. One day of divergence

does not necessarily entail the end of the current primary bull swing. However,

it is a yellow light, especially when this divergence occurs at extremely

overbought levels.

I also see that the silver and gold ETF miners (SIL

and GDX) have failed to make higher highs. Here we have down-side confirmation.

Volume was insane during the last few days.

So if I take into account that:

- Volume has increased dramatically.

- The news and general mood are too bullish (I even received whatapps congratulating me for my precious metals holdings).

- We see a divergence in gold and silver and outright failure to make higher highs in SIL and GDX, leaving gold alone in making higher highs.

- The last primary bear market lows for gold were made on 11/08/2019, and the swing that started off the last secondary reaction lows of 3/19/2020 has been running on for more than four months.

- A position taken in SIL on 4/9/2020 (see an explanation of why this was the sweet spot to buy for those fully understanding Rhea here) is currently yielding more than 60%.

I feel some traders might consider either one of the

following:

A. Partially lighten up some accounts (selling into strength) with the hope of rebuying at a lower price.

B. Wait until there is a mini pullback

(not qualifying as secondary reaction, it could be 1-2 days decline). Following

the mini pullback, no higher highs are made, and after that, the mini pullback

lows get jointly broken down. Upon the breakdown, sell to the sleeping point.

C. Do nothing and ride the

secondary reaction (if one finally sets in).

If your time is in short supply and/or lack the skills

to emulate Rhea, you might feel comfortable with the option shown at “C”: Do

nothing.

However, for those brave of heart, full of unrealized

profits, and deep knowledge of how to appraise the end of a secondary

reaction with the hope of rebuying at a lower level, options “B” or even “A”

(for a smaller sum) or a mix of all the options might be considered.

As this blog evolves, I become more and more convinced

that there is no single “right” way of trading. All that I explain here is Dow

Theory (who will contend that Rhea was no Dow Theorist?). Some “flavors” while

showing more promise (performance and less drawdown) require more focus and

knowledge, and do not lend themselves to fixed rules and back-testing (which

may test your patience in real trading, pun intended). Other flavors may be

less “flexible” but result in a more stress-free life. Eventually, it all

depends on the personal circumstances of each trader. What works for some

traders is unworkable for other traders. Hence, I feel that this blog rather than

pontificate about “exact” buy and sell signals (which will be given

nonetheless) should attempt to open the readers' minds about the different

trading possibilities that may be derived from the Dow Theory.

No charts are necessary. Just put your imagination to

work

Sincerely,

One Dow Theorist