Update on the

trends for precious metals.

US INTEREST RATES

General Remarks:

In

this post, I provided a thorough

explanation concerning the rationale behind my use of two alternative

definitions to appraise secondary reactions.

TLT is the

iShares 20 years + Treasury bond ETF. More about it here

IEF is the

iShares 7-10 years Treasury bond ETF. More about it here.

Thus, TLT

tracks longer-term US bonds, whereas IEF tracks middle-term US bonds. A bull

market in bonds entails lower interest rates. A bear market in bonds represents

higher interest rates.

A) Market

situation if one appraises secondary reactions not bound by the three weeks and

1/3 retracement dogma.

The primary trend was

signaled as bearish on 1/5/22, as I explained here.

As I

explained here, the secondary trend was signaled as bullish (secondary

reaction) on 5/25/22.

The last secondary reaction closing highs were made on

5/25/22 (TLT) and 5/27/22 (IEF) – Step #2 on the table below- . After those

highs, a pullback (Step #3) set up both ETFs for a primary bull market signal

on 6/1/22. Following that date, the pullback continued lower.

So now we have two options:

a) Either TLT and IEF break up above the secondary

reaction highs (Step #2), which would signal a primary bull market.

b) Or both TLT and IEF break down below the last

recorded primary bear market lows (Step #1), which would reconfirm the ongoing

bear market & cancel the current secondary reaction.

We sit and wait.

Below the updated charts. The purple rectangles

display the secondary reaction against the primary bear market. The brownish

rectangles show the current pullback that set up both ETFs for a primary bull

market signal. The darkest one highlights the date when the setup for a bull

market signal was first completed. The blue horizontal lines show the relevant

levels to be broken topside for a new bull market. The red ones show the price

levels to be breached for a reconfirmation of the bear market.

B) Market

situation if one sticks to the traditional interpretation demanding more than

three weeks and 1/3 confirmed retracement to declare a secondary reaction.

The primary

trend was signaled as bearish on 9/28/21. A more aggressive and legitimate

interpretation would have signaled the bear market on 9/24/21. The explanations

here.

In my 12/3/21 post, I wrote that the rallies that had until then

developed did not qualify as a secondary reaction. The situation has not changed,

as the current rally has not fulfilled the time requirement.

GOLD AND

SILVER

A) Market situation if one appraises secondary reactions not bound by

the three weeks dogma.

The primary trend was signaled as bullish on 11/11/21, as I explained here. Despite the current pullback, the trend remains

bullish.

The secondary trend is bearish (secondary reaction against the bullish

trend), and the setup for a primary bear market signal has been completed, as I

explained here.

Since that post, the technical situation has not changed. Below is the

updated table displaying the technical situation:

From

a Dow Theory perspective, there are three possible outcomes:

1) Either GLD and SLV jointly break up above their

last 3/8/22 bull market highs (Step #1), in which case the primary bull market

would be reconfirmed, and the secondary reaction terminated.

2) Or GLD and SLV jointly break down below their

secondary reaction lows (Step #2) which would signal a primary bear market.

3) Or GLD breaks down below the lows of the last

completed secondary reaction (12/2/21 @ 165.24), which would confirm SLV’s

breakdown and signal a primary bear market.

B) Market situation if one sticks to the

traditional interpretation demanding at least three weeks of movement to

declare a secondary reaction.

The primary trend was signaled as bullish on 3/1/22,

as was explained here.

Off the 3/8/22

closing highs, SLV declined until 5/12/22, and GLD fell until 5/13/22. The drop

amply exceeds the time (15 days) and extent requirement for a secondary

(bearish) reaction against the primary bull market. It also exceeds the

Volatility-Adjusted Minimum Movement (VAMM)

to qualify as a secondary reaction.

The Table below displays the price action since the

primary bull market highs:

On 5/10/22, SLV broke down below the 9/21/21 primary

bear market lows unconfirmed by GLD. Absent confirmation, no primary

bear market was signaled.

So now we have the following options:

1)

Either GLD and SLV jointly break up above their last 3/8/22 bull market highs

(Step #1), in which case the primary bull market would be reconfirmed and the

secondary reaction terminated.

2) Or GLD and SLV jointly break down below their

secondary reaction lows (Step #2) which would signal a primary bear market.

3) Or GLD breaks down below the lows of the last primary

bear market (9/29/21 @ 161.32), which would confirm SLV’s breakdown and signal

a primary bear market too.

The

charts below display the most recent price action. The brownish rectangles

highlight the secondary (bearish) reaction against the primary bull market. The

violet rectangles on the right side of the chart display the bounce that sets

up GLD and SLV for a primary bear market signal. The red horizontal lines

highlight the relevant price levels to be broken out for a bear signal to be

signaled. The blue horizontal lights show the last primary bull market highs which have to be jointly broken topside to cancel the current secondary reaction.

GOLD AND

SILVER MINERS ETFs

A) Market situation if one appraises secondary reactions not bound by

the three weeks dogma.

The primary trend was

signaled as bullish on 3/10/22, as I explained here. Despite the current pullback, the trend remains

bullish.

Please read my post of May 26th, 2022, for an accurate rendering of the current

situation (namely, secondary reaction and set up for a potential primary bear

market signal completed). Since that post, the technical situation has not

changed.

B) Market situation if one sticks to the

traditional interpretation demanding at least three weeks of movement to

declare a secondary reaction.

The primary

trend was signaled as bearish on 8/9/2021, as was explained here.

Starting at the 1/28/22

closing lows, SIL rallied until 4/13/22 @39.54. GDX rallied until 4/18/22

@40.87. Such a rally amply exceeded the time (15 trading days) and extent

requirement for a secondary reaction against the primary bear market. Following

such highs, the ensuing pullback set up both ETFs for a primary bull market

signal (>=2 days drop and Volatility-Adjusted Minimum Movement –VAMM-

exceeded).

The Table below contains

all the relevant data:

On 5/6/22, SIL broke down

below its 1/28/22 bear market closing lows unconfirmed by GDX. This

specific lack of confirmation has three consequences:

a) The primary bear market

has not been reconfirmed (which is slightly bullish).

b) The secondary reaction

(Step #2 on the Table) against the primary bear market has not been canceled.

c) The setup for a

potential primary bull market signal remains in force.

Please mind that on 3/1/22, GDX broke up above the

highs of the last completed secondary reaction (pink horizontal lines on the

charts below), unconfirmed by SIL. Thus, lacking confirmation, a primary

bull market was not signaled.

So now we have the following options:

1) SIL breaks up above the highs of the last completed

secondary reaction (the 11/12/21 highs, pink

horizontal line on the chart below), which would signal a primary bull market.

2) GDX and SIL break topside their secondary reaction

closing highs (Step #2, blue horizontal line on the charts below), which would

also signal a primary bull market.

3) GDX breaks down below its 1/28/22 closing lows (last

primary bear market lows), which would confirm SIL’s breakdown and cancel the

current secondary reaction and, with it, the setup for a primary bull market

signal.

The charts below display the current technical situation:

Overview: The spreadsheet below displays the primary trend in the pairs SLV/GLD

and SIL/GDX when we appraise them with either the "shorter-term" or

"longer-term" interpretation of the Dow Theory. The red color

displays a primary bear market, and the blue displays a primary bull market.

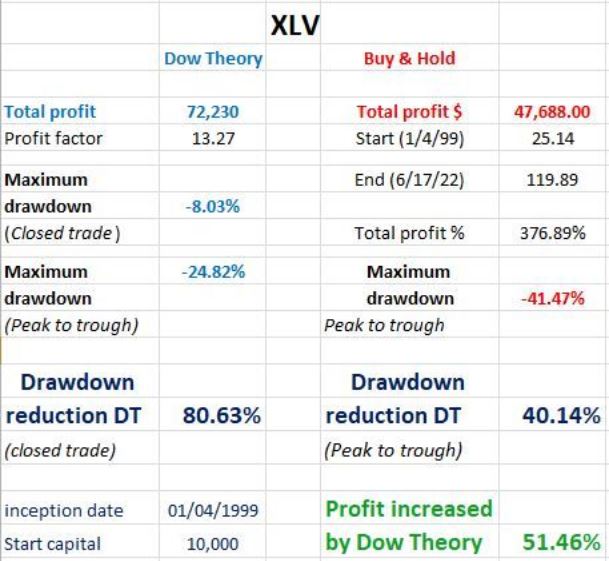

For those questioning whether all these charts actually work, I encourage them to read the following posts that prove with hard and fast data the marked drawdown reduction and outperformance achieved by the Dow Theory. For U.S. BONDS:

http://www.dowtheoryinvestment.com/2022/02/dow-theory-update-for-february-16-does.html

http://www.dowtheoryinvestment.com/2022/03/dow-theory-update-does-dow-theory-work.html

http://www.dowtheoryinvestment.com/2022/03/dow-theory-update-does-dow-theory-work_22.html

For Precious Metals and their ETF miners (GDX and SIL):

http://www.dowtheoryinvestment.com/p/dow-theorys-performance-when-applied-to.html

Sincerely,

Manuel Blay

Editor of

thedowtheory.com