Overview: On 2/13/24, January’s Consumer Price Index (CPI) exceeded expectations, triggering significant market upheaval. The Headline CPI saw a 0.3% month-over-month increase compared to the previous month’s 0.2% rise.

This unexpected development led to widespread turmoil:

- Stocks plummeted.

- Precious metals and their mining stocks declined.

- U.S. treasuries experienced substantial drops amid concerns over higher inflation and the likelihood of delayed interest rate cuts.

While U.S. stock indexes are far from a bear market, the adverse news on February 13th, 2024, pushed precious metals and bonds into new bear market territory.

In my 2/6/24 post titled “Gold’s downturn? Dow Theory Signals Market Risks Ahead” I accurately alerted of a potential shift to a bearish trend in precious metals. As is often the case, price movements tend to precede news, so weakness was already evident before the bad CPI print.

The precious metals market is currently experiencing a significant bearish bias. The long-term assessment of the Dow Theory remains bearish, and SLV’s non-confirmation of GLD’s higher highs on December 27th, 2023, is a yellow flag (or even a reddish one). Furthermore, the short-term assessment of the Dow Theory (see below) shifted to bearish on February 13th, 2023, which adds more weight to the bearish case.

General Remarks:

In this post, I extensively elaborate on the rationale behind employing two alternative definitions to evaluate secondary reactions.

GLD refers to the SPDR® Gold Shares (NYSEArca: GLD®). More information about GLD can be found HERE.

SLV refers to the iShares Silver Trust (NYSEArca: SLV®). More information about SLV can be found HERE.

A) Market situation if one appraises secondary reactions not bound by the three weeks and 1/3 retracement dogma.

As I explained in this post, the primary trend was signaled as bullish on 11/27/23.

Following a pullback (secondary reaction against the bullish trend), both TLT and IEF experienced a bounce, setting up both ETFs for a potential primary bear market. You can find detailed explanations and charts HERE.

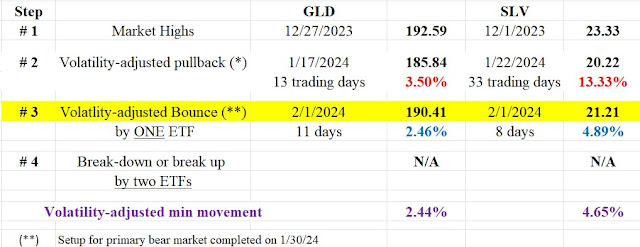

The table below furnishes relevant information:

On 2/13/24, GLD and SLV broke down below their 2/1/24 pullback lows (Step #2). Since it was a confirmed breakdown, a primary bear market was signaled according to the Dow Theory.

Check out the chart below for a visual walkthrough of the recent price action. The brown rectangles highlight the secondary reaction (Step #2), the blue rectangles showcase the rally (Step #3) originating from the secondary reaction lows that set up both ETFs for a potential bear market signal, and the red horizontal lines pinpoint the pullback lows whose joint violation signaled the new “bear market.” The blue horizontal lines highlight the last recorded primary bull market highs (Step #1), whose breakup would signal a new primary bull market.

Thus, both the primary and secondary trends are currently bearish.

B) Market situation if one sticks to the traditional interpretation demanding more than three weeks and 1/3 confirmed retracement to declare a secondary reaction.

As I explained HERE, the primary trend was signaled as bearish on 6/21/23.

Following the bear market lows on 10/5/23, there was a strong bounce until 12/1/23, which qualifies as a secondary reaction against the bear market given that both the time (at least 15 days confirmed) and extent requirements were met.

The extent requirement demands that both ETFs rally more than the Volatility-Adjusted Minimum Movement (VAMM). You can get more information about the VAMM HERE.

After the bounce highs (Step #2), a pullback ensued until 12/12/23. This pullback exceeding the VAMM and lasting >=2 days set up GLD and SLV for a potential primary bull market signal. If GLD and SLV jointly broke topside their 12/1/23 closing highs, a primary bull market would be signaled. On 12/27/23, GLD surpassed its 12/1/23 secondary reaction highs (Step #2), unconfirmed by SLV. One of the Dow Theory tenets is that we need confirmation for a signal to be given. In the absence of confirmation, no new primary bull market was signaled.

The table below shows the key dates and prices:

So, now we have the following options:

- Should SLV experience a rally and surpass its closing highs from December 1st, 2023, it would provide confirmation, signaling a new primary bull market. However, considering the absence of sudden price surges, this possibility seems improbable in the foreseeable days or weeks.

- Alternatively, if GLD and SLV continue to decline and breach their bear market lows from October 5th, 2023, three outcomes would arise:

a) The secondary reaction against the bear market would be canceled.

b) The setup for a potential primary bull market would be nullified, too.

c) The primary bear market would be confirmed.

Explore the chart below for a visual representation of recent price movements. The blue rectangles denote the secondary reaction (Step #2) originating from the October 5th, 2023, bear market lows (Step #1). The brown rectangles indicate the pullback (Step #3) after the latest market highs (Step #2). The secondary reaction highs (Step #2) are highlighted by blue horizontal lines, whose confirmed breach would signal a new primary bull market (currently highly improbable). Lastly, the red horizontal lines represent the October 5th, 2023, bear market lows (Step #1), whose confirmed penetration would reconfirm the ongoing bear market.

Sincerely,

Manuel Blay

Editor of thedowtheory.com