Bearishness seems quite entrenched

I’m tight on time, so I’m going to cut to the chase. So please bear with any typos or defective English. No much time for editing. But what really counts is the message and being on the right side of the market more often than not.

US STOCKS

Schannep’s Dow Theory (more properly: The Dow Theory for the 21st Century)

On 1/20/2020, the primary trend was bullish since April 6th, 2020, as was explained here.

The secondary trend is bullish since 11/13/2020 (successful termination of a secondary reaction), as was explained here.

Please mind that lots of interesting research are being published at thedowtheory.com. For example, we are discussing profit objectives, clues as to new secondary reactions, impending tops, tests proving the value of the principle of confirmation, etc. So many things are going in our monthly Letter which are not being published on this blog. So, I encourage you to become Subscribers, as you are missing a great piece of the action. Our "timing" has been spot on. Furthermore, Subscribers are alerted in real-time of any impending Buy or Sell signal, secondary reactions, etc.

“Rhea’s /classical" Dow Theory

A) Market situation if one is to appraise secondary reactions not bound by the 3 weeks dogma.

The primary trend is bullish since 4/29/2020, as explained here. This primary bull market signal was determined by just demanding 13 and 18 trading days to appraise the secondary reaction that led to the primary bull market signal.

Some months ago I wrote a “saga” (here, here and here) where I made clear that neither the 15 days time requirement nor the 1/3 extent requirement is carved in stone. While most secondary reactions will last more than 15 days and retrace 1/3 of the previous swing, one should remain flexible, even under the “Rhea/classical” Dow Theory.

The secondary trend is also bullish, as was explained in depth here.

B) Market situation if one sticks to the traditional interpretation demanding more than three weeks of movement in order to declare a secondary reaction.

For those strictly demanding more than 15 confirmed days of declining prices, the primary bull market was signaled on 5/26/2020. More details about this alternative signal are to be found in our June 1st, 2020 Letter to Subscribers.

The secondary trend is also bullish, as was explained in depth here.

GOLD AND SILVER ETFs

A) Market situation if one is to appraise secondary reactions not bound by the 3 weeks dogma.

The primary trend was signaled as bearish on 11/27/2020, as was profusely explained here.

The secondary trend is bullish (secondary reaction against the primary bear market), as was explained here.

Following the secondary reaction highs of 1/5/2021, there was a pullback until 1/15/2021. As you can see in the spreadsheet below, such a pullback had enough volatility-adjusted extent to setup SLV and GLD for a primary bull market signal.

Thus, we now have three alternatives:

1. Either the 1/5/2021 secondary reaction closing highs got jointly broken up in which case a primary bull market would be signaled.

2. Or the 11/6/2020 closing highs of GLD get broken topside by GLD in which case a primary bull market would be signaled. Explanation: The highs of the last completed secondary reaction (not the current one, the previous one) serve as valid points to derive signals. SLV broke topside on 12/17/2020 its 11/6/2020 last completed secondary reaction highs unconfirmed by a hair by GLD. So, if GLD confirmed, a primary bull market signal would be given. Long-time readers of this blog know that I am an ardent believer (my tests with US stock indexes prove me right) on the validity of the highs/lows of the last completed secondary reaction as a valid pivot to derive accurate signals. More about this subject here and here.

3. Or SLV and GLD jointly break down below their 11/30/2020 primary bear market closing lows in which case the primary bear market would be reconfirmed.

The charts below displays the current situation. The blue rectangles on the left side of the charts display the last completed secondary reaction. The blue rectangles on the right side of the charts display the current secondary reaction. The orange rectangles show the pullback that setup the precious metals for a primary bull market signal. The blue horizontal lines display the relevant price levels to be broken topside for a primary bull market signal to be given (I show both the highs of the current secondary reaction and those of the last completed one).

So, we have to await the final verdict of the market. In the meantime, we give the benefit of the doubt to the current primary trend, which is bearish.

B) Market situation if one sticks to the traditional interpretation demanding more than three weeks of movement in order to declare a secondary reaction.

The primary trend was signaled as bearish on 11/27/2020, as was explained here.

Off the 11/30/2021 bear market lows both SLV and GLD rallied for 24 trading days until 1/5/2021. So the time requirement was more than met. As to the extent requirement, it was fully met. Both percentage-wise as in terms of retracements of the previous bear market swing which started on 11/6/2020. Please spare me the calculations as the chart patterns speak for themselves.

So the secondary trend is bullish (secondary reaction against the primary bear market).

Now we have an instance when both the “shorter-term” interpretation of the Dow Theory and the longer-term one are in gear. Thus, all I explained under the heading “A” is fully applicable here: We have a setup for a primary bull market signal and there are three alternatives (see above). The charts are the same as under the heading “A” so no need to include them here.

GOLD AND SILVER MINERS ETFs

A) Market situation if one is to appraise secondary reactions not bound by the 3 weeks dogma.

The primary trend was signaled as bearish on 11/23/2020, as was profusely explained here.

The secondary trend is bullish (secondary reaction against the primary bull market), as was explained here.

Following the 1/5/2021 closing highs for SIL and 1/4/2021 for GDX, a huge pullback materialized until 1/27/2021. Please spare me the calculations, as it is more than evident that such a pullback amply exceeds the volatility-adjusted minimum movement.

So, the setup for a primary bull market signal has been completed.

Thus, we now have three alternatives:

1. Either the 1/5/2021 (SIL) and 1/4/2021 (GDX) secondary reaction closing highs got jointly broken up in which case a primary bull market would be signaled.

2. Or the 11/6/2020 closing highs of GDX get broken topside by GDX in which case a primary bull market would be signaled. Explanation: The highs of the last completed secondary reaction (not the current one, the previous one) serve as valid points to derive signals. SIL broke topside on 1/4/2021 its 11/6/2020 unconfirmed by a wide margin by GDX. So, if GDX confirmed, a primary bull market signal would be given.

3. Or SIL and GDX jointly break down below their 11/24/2020 primary bear market closing lows in which case the primary bear market would be reconfirmed.

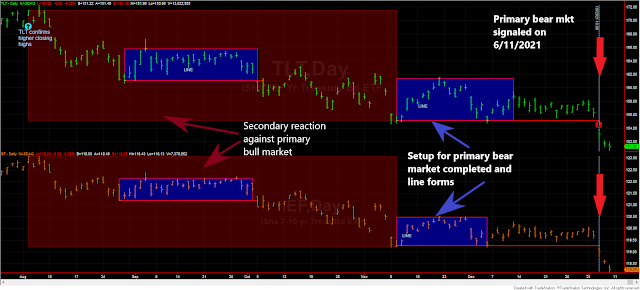

Here you have the updated charts:

The blue rectangles on the left side of the charts display the last completed secondary reaction. The blue rectangles on the right side of the charts display the current secondary reaction. The orange rectangles show the pullback that setup the precious metals for a primary bull market signal. The blue horizontal lines indicate the relevant price levels to be broken topside for a primary bull market signal to be given (I show both the highs of the current secondary reaction and those of the last completed one).

B) Market situation if one sticks to the traditional interpretation demanding more than three weeks of movement in order to declare a secondary reaction.

For those wishing to adhere to a more strict interpretation when determining secondary reactions, the primary trend would have remained bearish (bearish signal given on March 11th, 2020, as explained here) until 05/15/2020. On 05/15/2020 SIL finally broke up its last recorded primary bull market closing highs of 12/26/2019, and a primary bull market was signaled. GDX had done so on 4/22/2020. Thus, even under the most restrictive interpretation of the Dow Theory, the primary trend was signaled as bullish on 05/15/2020

The secondary trend is bearish (secondary reaction) against the primary bull market, as explained here.

On January 4th, I explained that the setup for a primary bear market signal had been completed.

Nothing had technically changed since January 4th. Thus, if the 11/24/2020 secondary reaction closing lows were jointly broken, a primary bear market would be signaled.

Overview:

The spreadsheet below displays the primary trend in the pairs SLV/GLD and SIL/GDX when we appraise is with either the “shorter-term” or longer-term interpretation of the Dow Theory. If one committed ideally 25% to each pair and trading style (shorter or longer-term) we would currently be 75% on cash and 25% invested. Red color displays a primary bear market (cash), and blue color displays a primary bull market.

US INTEREST RATES

Nothing has changed since my post of January 8th, 2021. I can only say that it is more likely than not that the primary bear market get reconfirmed. However, we wait.

Sincerely,

Manuel Blay

(One Dow Theorist)