Good (and less good) trend following

This is an important post as it will dispel some trend-following myths. I plan to expand this post in the future or write additional posts on this subject.

What makes an excellent trend-following system? A good trend-following system must meet four requirements:

1. It must reduce drawdowns. Yes, this is the first requirement, not the quest for outperformance.

2. It must be a source of outperformance using the very benchmark index (i.e., the S&P500). We must do something other than trick by using specific stocks and comparing their performance to the benchmark. It must be an apples-to-apples comparison.

3. It must trigger seldom. Anyone trading typical moving averages knows that when the price is near the average, spells of overtrading arise.

4. However, it may be able to trigger every day if

need be. Why? In the event of crashes like October 1987, August 1988, or Mach

2020, you need to react quickly.

Points 3 and 4 deserve special attention. A common

problem with moving averages (MA) and rate of change systems is the risk of being repeatedly whipsawed when the price sits

near the moving average. To avoid such whipsaws, many people advocate using

monthly bars instead of daily bars, which limits trades to at most one per

month: problem fixed. Right? You use a MA based on monthly bars, and we kill two birds

with one stone: We fix the whipsaw problem and increase performance.

However, if we look under the hood, we observe that cutting down the number of

trades comes at a huge price: The risk of being caught wrong-footed in sudden

crashes increases exponentially if we just have one day per month to exit. Most

trend-following strategies based on monthly bars would not have escaped early

enough before the great sudden crashes occurred. Very few investors can remain

disciplined in trading a system that does not react when the markets start

falling in earnest. One thing is to look at a backtest (“I would have ridden

the storm in March 2020, as the market went back again”). One different thing

is to stick to the system when real money is on the line. We should not underestimate our frailty. As legendary trader Paul Tudor Jones said "don't play macho with the markets".

So real investors, not paper ones, would resort to daily bars. However, as stated above, daily bars result in whipsaws and, worse, an evident inability to outperform buy and hold (at least if one does not cheat by applying the moving average to a top-performing stock and comparing it to the benchmark).

Thus, most trend-following systems are in a catch-22 situation: If I want to react early enough when a big drop sets in and cut drawdowns effectively, I will be unable to outperform B&H and will be overtrading in choppy markets. If I want to avoid whipsaws, then I’ll risk getting out (and “in”) too late.

The chart below compares a 200-day moving average (the “standard” one) against B&H on the S&P500 from 1/1/1975 to 12/31/2021:

As you can see, the MA based on daily bars is good at dampening drawdowns but fails miserably at outperforming B&H. I carried out the test without slippage and commissions. If I had factored them in, the results would have been even more horrible for the MA. So, it is true that a MA may result in outperformance on risk-adjusted terms (lower return but even lower drawdown that B&H). However, MAs have a hard time beating B&H.

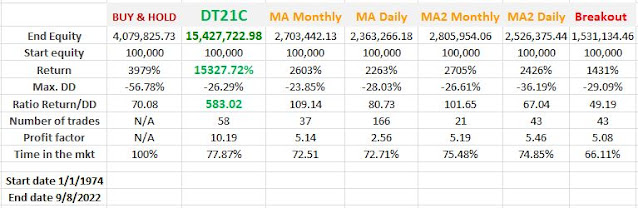

The table below compares different trend-following approaches v. B&H on the S&P500. From left to right, we show B&H, the Dow Theory for the 21st Century (DT21C), a 9-month MA, a 200-day MA, a 9-month MA with the additional requirement of the MA turning up or down to trigger a signal, a 200-day MA with the exact additional requirement, and, finally a breakout system (77-days high/low for a signal). The test starts on 1/1/1974 and finishes on 9/8/2022. The start equity is $100,000:

We observe that the two variations of monthly MA and

the plain vanilla MA (without demanding in addition to the crossover that the

trend of the MA is up or down for a signal) deliver a better risk-adjusted

profile than B&H (Return/Max Drawdown, the higher the number, the better).

We also observe that the MA based on daily bars had 166 trades v. only 37 for

the equivalent based on monthly bars. There are no shortcuts. The breakout system

fared poorly. While it cut drawdowns handsomely, it was an inferior performer,

and risk-adjusted underperformed B&H.

All in all, you cannot expect wonders from “traditional”

trend following. The only trend-following system that markedly outperformed

B&H and delivered an outstanding risk-adjusted figure with a moderate

number of trades was the DT21C. For those versed in the DT21C, it should not be

surprising. The chart below says it all:

While not shown here (this is the subject for another post in the future), my Blay Timing Indicator also managed to outperform B&H vastly, cut drawdowns, and keep the total number of trades low.

Sincerely,

Manuel Blay

Editor of thedowtheory.com