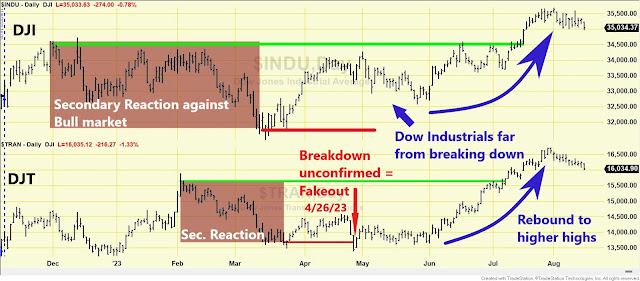

The setup for a primary bull market was completed on 8/2/23

General Remarks:

In this post, I thoroughly explained the rationale behind my use of two alternative definitions to appraise secondary reactions.

GOLD AND SILVER

A) Market situation if one appraises secondary reactions not bound by the three weeks dogma.

I explained HERE that gold and silver have been in a primary bear market since 6/21/23.

Following the June 2023 lows, a rally followed that qualified as a secondary reaction against the primary bear market. More details about the secondary reaction HERE.

A pullback followed. On 8/17/23, GLD broke down below its 6/29/23 primary bear market lows at 177.09 unconfirmed by SLV. SLV stopped its plunge on 8/16/23 at 20.56 without violating its 6/22/23 primary bear market lows at 20.53. As shown, in the table below the pullback lasted >=2 days and amply exceeded the Volatility-Adjusted Minimum Movement (more about the VAMM HERE). Thus, the setup for a potential primary bull market signal has been completed. The Table below shows the details:

a) A new primary bull market will be triggered if GLD and SLV jointly break topside their respective bounce highs (Step #2 in the above Table) at 183.64 and 23.10, respectively.

b) If SLV broke down below the 6/22/23 low at 20.53, confirming GLD’s previous breakdown, the primary bear market would be confirmed, and the secondary reaction would be terminated.

The chart below illustrates the most recent price action. The red lines

show the primary bear market lows (Step #1). The blue rectangles display the

secondary (bullish) reaction against the bear market (Step #2). The blue

horizontal lines highlight the secondary reaction highs, which are the relevant

levels to be jointly surpassed for a new bull market to be signaled. The brown

rectangle displays the pullback on the date when the setup for a potential

primary bull market was completed:

As I explained HERE, the primary trend was signaled as bearish on 6/21/23.

The latest rally has not persisted for a minimum of 15 confirmed trading days, leading to the absence of a secondary reaction.

Consequently, both the primary and secondary trends remain bearish.

Sincerely,

Manuel Blay

Editor of thedowtheory.com