Three Smarter Ways to Cut Drawdowns Without Killing Performance

The core issue with buy-and-hold investing is simple: drawdowns. Big ones. They may be inevitable, but that doesn’t make them any less damaging—both financially and psychologically.

To address this, many investors turn to buffered ETFs, hedging with puts, or going short. But there’s a catch: these protective strategies come at a steep price. They can sap performance, require precise execution, and often fail to provide consistent results when you need them most. In short, they cost money—and they typically dilute returns.

Another response is to do… nothing. Just “weather the storm.” After all, markets always recover—right? That’s the theory. But in practice, this approach falters for two big reasons:

- Most investors drastically overestimate their tolerance for drawdowns. It’s easy to say, “I can handle a 50% drawdown”—until it actually happens. In real life, drawdowns don’t just hurt portfolios—they wreck confidence and cause people to bail out at the worst possible moment.

- The U.S. market is the exception, not the rule. Historically, the S&P 500 has shown an incredible ability to bounce back from deep losses and hit new highs. But many global markets haven’t. European indices, for example, have gone decades without recovering prior peaks. And who’s to say the U.S. will remain exceptional forever?

So what are investors left with?

You can either:

✅ Weather the storm and risk getting crushed by a massive drawdown,

or

✅ Hedge and accept the long-term performance drag that comes with it.

Neither option is ideal.

That’s why I believe in a third path—one that sidesteps both the psychological toll of deep drawdowns and the performance drag of costly hedging. It’s built on three key pillars:

🔹 Market Timing

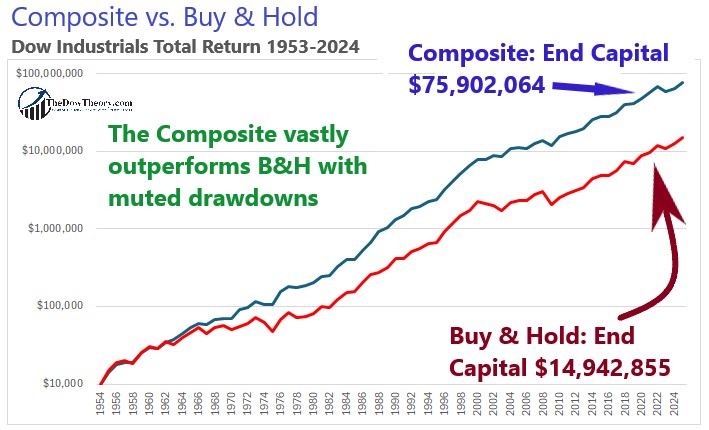

When properly executed, market timing is one of the very few strategies that can reduce drawdowns without incurring the costs of hedging—and often with the added benefit of outperformance. While it’s often dismissed, the reality is that trend-following and timing approaches, when grounded in data, are both cost-efficient and effective. My Composite Timing Indicator is a key example of such an approach.

The chart belows show the outperformance and marked drawdown reduction of the Composite:

🔹 Sector Rotation

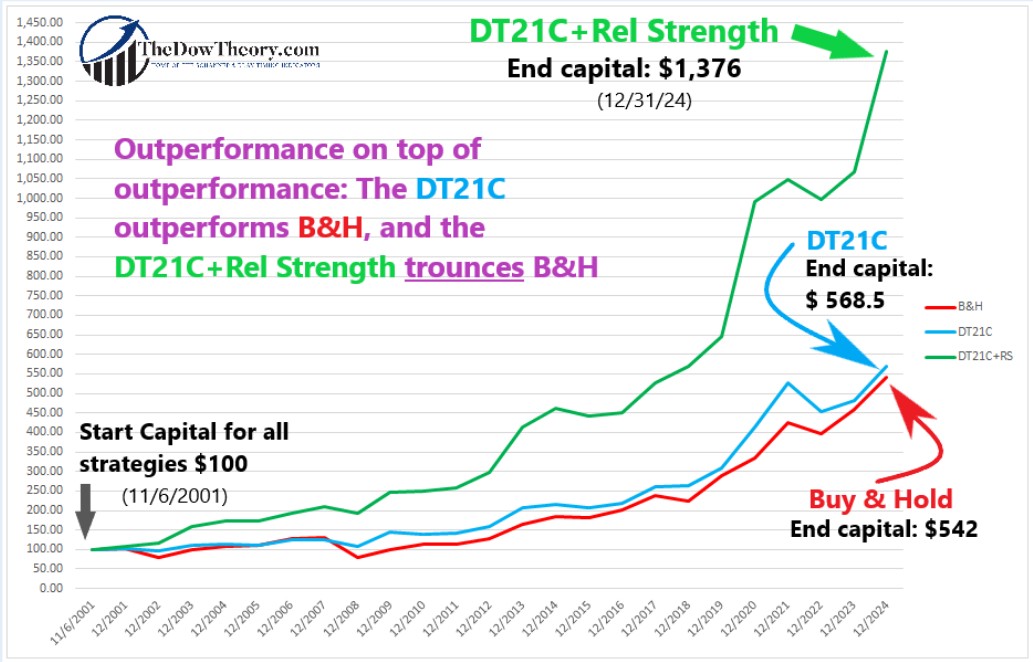

By dynamically shifting exposure across asset classes or market sectors, investors can sidestep underperforming areas and adapt to changing macro conditions. It adds another layer of diversification that helps absorb shocks without relying on expensive hedges. My Dow Theory + High Relative Strength strategy harnesses this principle by combining market timing with exposure to leading sectors.

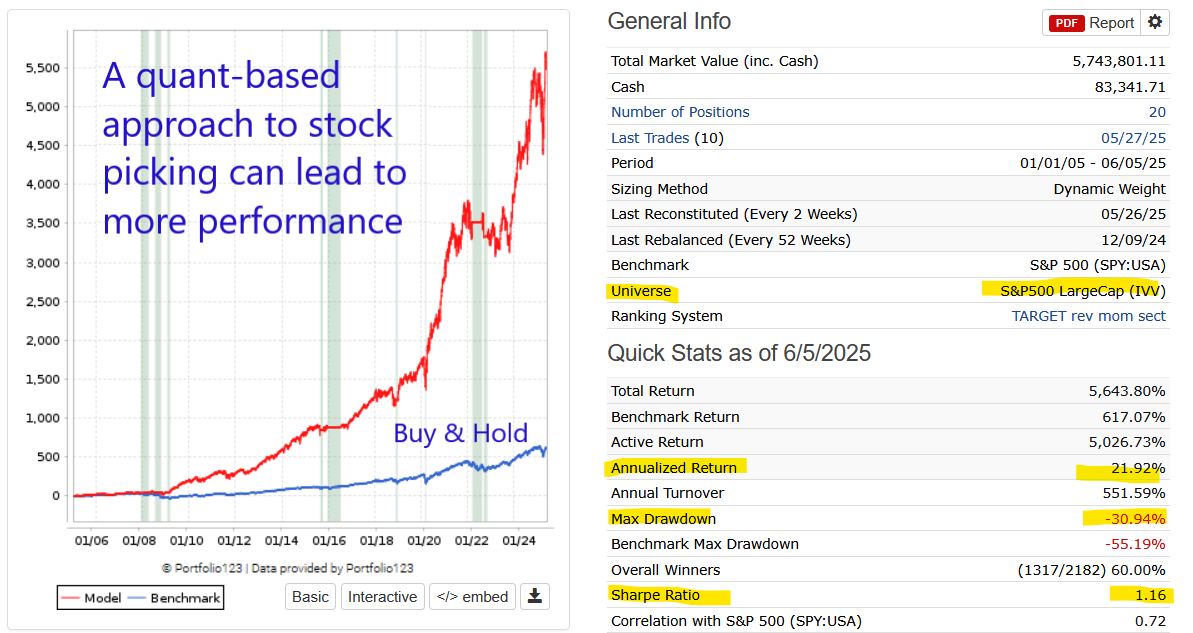

🔹 Quantitative Stock Selection

Finally, stock picking doesn’t have to be guesswork. Using a quantitative approach to select stocks with a proven statistical edge enhances the overall resilience and return potential of the portfolio—especially when combined with timing and sector rotation. Portfolio 123 is the tool to build a systematic stock selection process that filters out obvious “lemons” and tilts toward winners.

This is an example of what can be achieved with a good stock picking strategy:

No strategy is perfect, but combining these three elements can provide a robust framework to reduce drawdowns, sidestep prolonged underperformance, and—most importantly—keep you in the game.

Because the real risk isn’t just losing money.

It’s losing the discipline to stay invested when it matters most.

Sincerely,

Manuel Blay

Editor of thedowtheory.com