Primary bear market for GLD and SLV reconfirmed on 9/1/22.

Very soon, I will pen a new post concerning GLD and SLV. The overall picture for precious metals is bearish. I don't want to give names, but when I signaled a primary bear market, I was criticized. The perma-bulls had an arsenal of reasons for being bullish (precious metals are good value, the breaching of the lows is just "stop running", physical stocks are dwindling, etc.), so my turning bearish was rationalized away. Can the trend bearish trend change? Of course it can, but price action will let us know. As Dow Theorist Rhea wrote: "The wish must never be allowed to father the thought"

GOLD AND SILVER MINERS ETFs

A) Market situation if one appraises secondary reactions not bound by the three weeks dogma.

As I explained here, the primary trend was signaled as bearish on 6/23/22.

A secondary reaction against the bearish trend developed and thereafter the setup for a potential primary bull market signal was completed, as was explained here.

http://www.dowtheoryinvestment.com/2022/08/dow-theory-update-for-august-25-setup.html

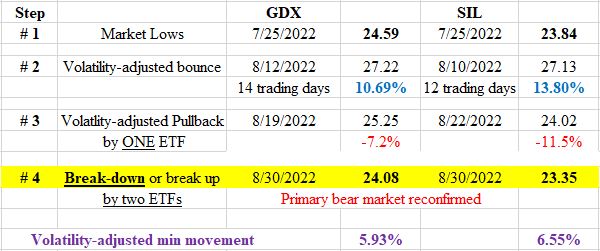

On 8/30/22, SIL and GDX jointly breached their 7/25/22 closing lows which implies:

a) The secondary (bullish) reaction has been canceled.

b) The primary bear market has been reconfirmed.

So, now the primary and secondary trends are bearish.

Below you have the table depicting the most recent price action:

Below the updated charts:

B) Market situation if one sticks to the traditional interpretation demanding at least three weeks of movement to declare a secondary reaction.

The primary trend was signaled as bearish on 8/9/2021, as was explained here.

On 6/14/22, the primary bear market was re-affirmed (confirmed lower lows). Now both the primary and secondary trend is bearish.

The rally that started off the 7/25/22 closing lows did not reach at least 15 trading days on both ETFs, so there was no secondary reaction. Lower lows on 8/30/22 “reset” the counter for a potential secondary reaction to zero. Therefore, the primary and secondary trends remain bearish.

Sincerely,

Manuel Blay

Editor of thedowtheory.com

No comments:

Post a Comment