The primary trend remains bearish, though

It has been a long time without providing an update concerning US bonds. In fact, it was not necessary as the trend has been “down” for many months now, so no changes occurred.

I am writing before the close, so things might change.

US INTEREST RATES

General Remarks:

In this post, I provided a thorough explanation concerning the rationale behind my use of two alternative definitions to appraise secondary reactions.

TLT is the iShares 20 years + Treasury bond ETF. More about it here

IEF is the iShares 7-10 years Treasury bond ETF. More about it here.

Thus, TLT tracks longer-term US bonds, whereas IEF tracks middle-term US bonds. A bull market in bonds entails lower interest rates. A bear market in bonds represents higher interest rates.

A) Market situation if one appraises secondary reactions not bound by the three weeks and 1/3 retracement dogma.

The primary trend was signaled as bearish on 1/5/22,

as I explained here.

After the onset of the primary bear market, prices

went down unabatedly. The occasional rallies were so modest and short-lived

that none of them qualified as a secondary reaction.

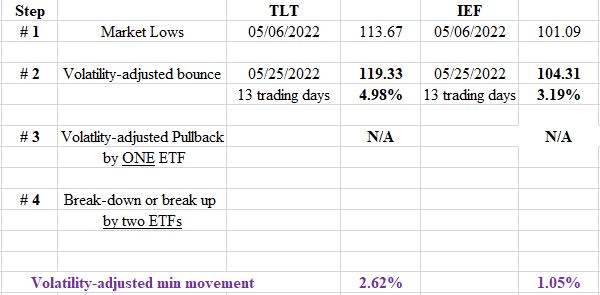

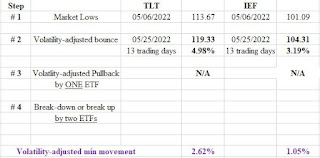

On 5/6/22, both TLT and IEF made their last recorded closing lows. A rally ensued until 5/25/22 that lasted 13 trading days. Accordingly, the time requirement for a secondary reaction was met. As to the extent requirement, both ETFs percentage-wise rallied more than the Volatility Adjusted Minimum Movement (VAMM), so the extent requirement was also met, and we can declare the existence of a secondary (bullish) reaction against the still existing primary bear market.

The Table below contains all the relevant data:

What options do we have now from a Dow Theory perspective?

1) We are waiting for a pullback on both TLT & IEF. If such a pullback exceeds the VAMM on at least one ETF and last 2 confirmed days, then the setup for a primary bull market would be completed.

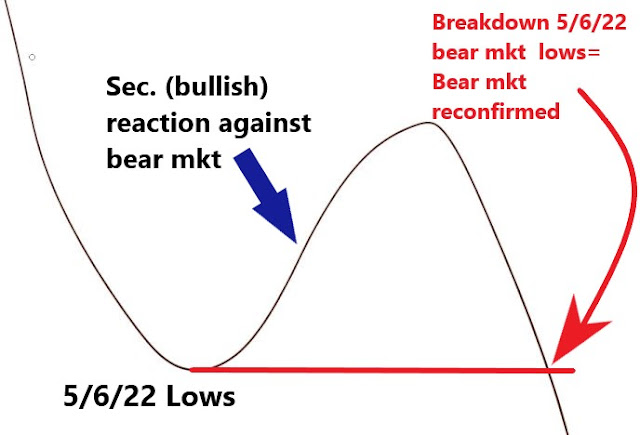

2) Such a pullback may continue lower until the 5/6/22 lows are jointly broken down by TLT and IEF, in which case, the primary bear market would be reconfirmed, and the secondary reaction canceled.

3) No pullback unfolds, and prices continue up until the last recorded primary bull market highs (12/3/21) are jointly broken topside, which would signal a new primary bull market. This is an improbable event, as a setup for a primary bull market will, most likely, develop at lower price levels.

The rough charts below serve to show the three alternatives:

|

OPTION ONE: A pullback sets up both ETFs for a primary bull market signal |

|

| OPTION TWO: The pullback breaks down below its Bear market lows |

|

| OPTION THREE: No pullback unfolds, rally continues until breaking up last bull mkt highs |

And below you have the updated charts. The violet rectangles

on the right side of the charts show the current secondary reaction. They grey rectangles in the middle of the charts display a rally that did not qualify as a secondary reaction.

B) Market situation if one sticks to the traditional interpretation demanding more than three weeks and 1/3 confirmed retracement to declare a secondary reaction.

The primary trend was signaled as bearish on 9/28/21. A more aggressive and legitimate interpretation would have signaled the bear market on 9/24/21. The explanations here.

In my 12/3/21 post, I wrote that the rallies that had until then

developed did not qualify as a secondary reaction. The situation has not

changed, as the current rally has not fulfilled the time requirement.

Sincerely,

Manuel Blay

Editor of thedowtheory.com

No comments:

Post a Comment