It's been a long time without analyzing stocks on this blog. Something caught my eye on the charts which I will share with you in this post.

Robert Rhea referred to two types of divergence. Firstly, the one we observe between daily closing prices: One index closes down while the other closes up. In his book “The Story of the Averages” (1934, page 190), Rhea wrote, “when two or more days’ divergence occurs after an extended and excited primary movement, such action is frequently the first indication of a secondary reversal”. The other type of divergence is when one index makes lower highs and lower lows, whereas the other makes higher highs and higher lows. The implications of divergence depend on where we are situated in a chart. If we are near a multiyear top, the most likely implication is that the trend will turn bearish, and the divergence shows money escaping one Index to find shelter in the other one. If divergence occurs after a secondary reaction, divergence tends to show that the reaction is running out of steam. Generally, divergence, which is a stronger warning than lack of confirmation, tells us that a big move is in the making, be it “up” or “down.”

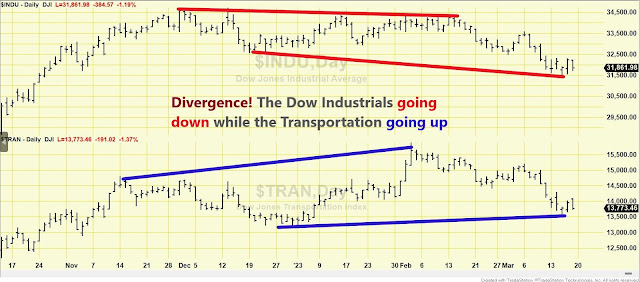

The charts below show that the Dow Industrials and Transportation have been seriously diverging. The Dow Industrials (top chart) has been making lower highs and lows, while the Dow Transportation has been making higher highs and lows. The total number of divergence days in the last 20 days has been 4, which is a neutral number (it can get as high as 8 or as low as 0).

Thus, it seems that the next leg, be it “up” or “down,” will be decisive. For the time being, the primary trend, according to the classical Dow Theory, is bullish, and the current pullback is just a secondary reaction.

And what about the trend when appraised by the Dow Theory for the 21st Century (aka. Schannep’s Dow Theory)? Schannep’s Dow Theory, since 1953, outperformed Buy and Hold by 3.03% p.a., with a marked reduction of both the depth and time in drawdown. Schannep’s Dow Theory achieved such an outperformance by investing only in the major indexes, which is quite a feat.

Do you want to know more? Become a Subscriber, and you’ll get access to a wealth of information (i.e., access to our Letters since 1962 and their concomitant trade recommendations, the power of the consumer confidence report as a timing device, the special report about the yield curve, how to calculate profit objectives that work, and much more). More importantly, you’ll be punctually updated through our email service of any change in trends and the specific ETFs making up our Dow Theory on steroids portfolio. Not accidentally, our Newsletter has consistently been ranked among the top investments Letters.

Sincerely,

Manuel Blay

Editor of thedowtheory.com

No comments:

Post a Comment